I’m not going to waste your time today. We’re diving right in.

The problem facing most gyms today (except for the best), is that they struggle to consistently get new clients without running out of money.

Because if we all had infinite amounts of money to spend on marketing, we’d be doing it right?

If you had no budget, you’d be spending money for tv ads, twitter campaigns, hulu ads, you name it.

But we don’t have that kind of money…

So the question becomes, how can I acquire clients without losing money?

Well, since you have to cover…

Ad spend, tech, coaches, utilities, and everything else.

It all starts to add up quickly.

Which means that you have two options…

Option #1: Use A Broken Model – (listen to the crowd booooo) – the one with free trials, low barrier offers, hopes and prayers…the same one that’s helping the industry maintain an 11.3% average net margin…and the one that leads to gym owners burning out, shutting down, and moving on.

Or Option #2: 30 Day Cash Model – a model that will consistently get new clients, cover your marketing costs and all expenses, and make you profitable in your first 30 days…otherwise known as a winning model.

“But Cale! What is the 30 Day Cash Model and how does one use it?”

Glad you asked…

This model can be used for any type of gym (or business) with any offer.

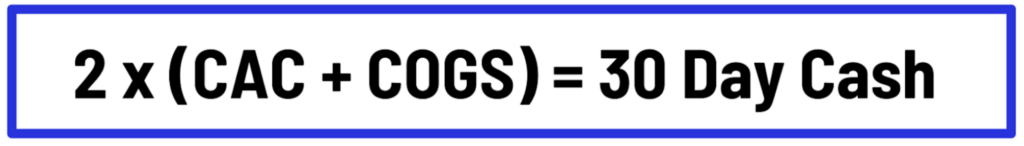

All you have to do is make sure you remember this equation…

Let’s walk through this equation – and for some of you, if you have a general idea of your numbers, you can figure this out right now.

And to reiterate, what we’re solving for is how much cash do we need to collect in a 30 day period so that we don’t need a marketing budget and we can make a profit…

So let’s start with CAC – which means Customer Acquisition Cost – how much does it cost you to acquire a new client.

What’s included in this is ad spend, commission, marketing tech costs, and anything other money that’s being spent during the acquisition process – which could include lead nurture costs and more.

So the equation to find CAC is Total Costs / Total Signups within a certain date range.

Ex: I spent $3000 this month and I signed up 15 new clients.

$3000 / 15 = $200 CAC

Ok, now let’s look at COGS (Cost of Goods Sold).

This is the cost to fulfill, or simply put, how much does it cost you in payroll to fulfill one client per month.

So the equation is Total Payroll Costs / # of Clients.

Ex: My payroll is $10,000 and I have an average of 150 clients per month.

$10,000 / 150 = $67 COGS

So our all in costs to acquire and fulfill on a new client within their first month is $267 (CAC + COGS) – so to AT LEAST break even during their first month and not dip out of pocket on my marketing budget, I would need to collect at least $267 per client in their first 30 days…but we don’t want to just break even on this client.

We want to cover the cost of the next client too.

Which is why we multiply this number by 2…

2 x $267 = 30 Day Cash

Because if we collect at least twice as much as it costs us to acquire and fulfill one client, we not only have enough money to go get the next client – we have enough to make a profit.

2 x $267 = $534

Which means we need to collect $534 within a new client’s first 30 days in order to not just cover their costs, but also cover the cost of the next customer…which means we can now join Elon and scale to Mars.

But how do we collect that much money in the first 30 days?

I’ll cover that next week…